Building Enduring Value Across Industries

We help high-growth companies and investors structure, govern, and scale regulated enterprises with operational discipline.

$2.5B+

ASSEST UNDER

MANAGMENT

40+

PORTFOLIO

COMPANIES

15+

YEARS OF

EXPERIENCE

"We invest in businesses where we can be true partners—contributing not just capital, but insight, relationships, and a shared commitment to building something lasting."

Carlos Alfaras—Chief Executive Officer

Our Philosophy

Disciplined Capital, Partnership Approach

Long-Term Orientation

We take a patient approach to value creation, focusing on sustainable growth over short-term gains. Our investment horizon allows companies the time to execute their strategies fully.

Operational Excellence

Beyond capital, we bring deep operational expertise to help portfolio companies optimize performance, enter new markets, and build competitive advantages.

Aligned Interests

We invest alongside our partners and management teams, ensuring our success is directly tied to the success of the businesses we support.

Investment Focus

Sector Expertise, Global Perspective

We focus our capital and resources on sectors where we have deep expertise and can add meaningful value beyond financial investment

Healthcare & Life Sciences

Precision medicine, genomics, pharmaceutical development, and healthcare technology companies at the forefront of patient care innovation.

Technology & Data

Enterprise software, data infrastructure, and digital platforms that enable businesses to operate more efficiently and intelligently.

Business Services

Companies providing essential services to other businesses, from logistics and distribution to professional services and outsourcing.

Consumer & Retail

Consumer brands and retail businesses with strong market positions, differentiated products, and growth potential.

Financial Services

Specialty finance, insurance, and financial technology companies serving underserved markets or offering innovative solutions.

Real Estate

Strategic real estate investments focused on value creation through development, repositioning, and operational improvements.

Partnering with Industry Leaders

Our portfolio spans healthcare, technology, and essential business services. We work closely with management teams to accelerate growth, improve operations, and create lasting value.

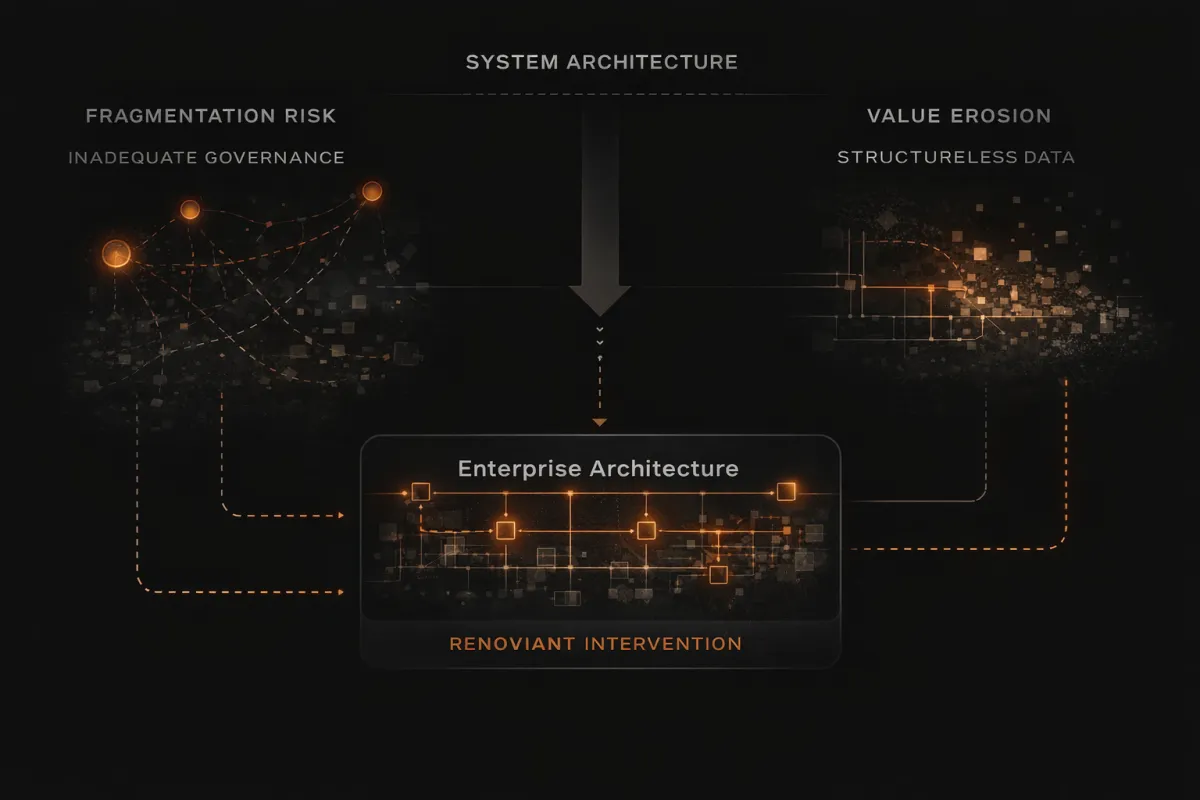

We Engage Where Structure, Scale, and Accountability Matter

Medical Operators & Leadership Teams

Renoviant works with executive teams leading medical, pharmaceutical, and health-technology organizations at moments of growth, transformation, or increasing complexity. Our partners are operators who recognize that enterprise structure, governance, and system design must evolve alongside innovation.

We engage where leadership is committed to long-term value creation—not short-term acceleration.

Investors & Strategic Capital

We partner with investors and capital groups seeking durable, well-governed medical enterprises. Renoviant supports capital by strengthening enterprise foundations early—reducing execution risk, preserving value, and enabling scale with discipline.

Our role is to align operational reality with investment intent.

That last sentence is very important. Do not soften it.

These capabilities operate together as a single enterprise system—not as standalone services.

Selective Engagement, Designed for Enduring Value

Renoviant does not operate as a vendor or short-term advisor.

We engage as a long-term enterprise partner where structure, governance, and accountability matter.

We Engage When the Following Conditions Are Present

We Engage When

Leadership is committed to enterprise-level governance

Capital strategy and operational reality must align

Scale, compliance, or complexity is accelerating

Long-term value creation is the objective

We Do Not Engage When

Speed is prioritized over structure

Governance is an afterthought

Engagement is limited to surface-level advisory

Short-term outcomes outweigh durability